China's Golden Week Travel Boom Hides Brutal Price War

Introduction: The Golden Week Illusion

China's Golden Week appears to be a tourism success story. Millions of people travel across the country. Hotels fill up quickly. Tourist spots become crowded. But beneath this busy surface, a different story unfolds. A fierce price war is hurting businesses. Travel companies slash prices to attract customers. This creates a difficult situation for everyone.

Golden Week happens twice each year in China. The National Day Golden Week occurs in October. The Spring Festival Golden Week happens in February. These are major holidays when people get time off work. They use this time to travel and visit family. The government created these holidays to boost spending.

On the surface, everything looks positive. Travel numbers break records each year. Spending appears strong. But industry insiders know the truth. Profit margins are shrinking rapidly. Companies compete by lowering prices. This creates a race to the bottom. Everyone loses in this situation.

This article will explore the real story behind Golden Week. We will examine the price war in detail. You will learn how it affects travelers and businesses. We will provide practical tips for smart travel during this period. Understanding this situation helps everyone make better decisions.

What is China's Golden Week?

The History and Purpose

China introduced Golden Week holidays in 1999. The government wanted to boost domestic tourism. They also aimed to increase consumer spending. The holidays give workers seven consecutive days off. This allows for extended travel and family visits.

There are two main Golden Week periods. The National Day Golden Week celebrates China's founding. It runs from October 1st to 7th. The Spring Festival Golden Week coincides with Chinese New Year. Dates vary each year based on the lunar calendar.

These holidays have been very successful at encouraging travel. In 2023, over 826 million trips occurred during National Day Golden Week. This represents a significant portion of China's population. The economic impact is massive.

Economic Impact and Significance

Golden Week generates enormous economic activity. In 2023, tourism revenue reached 753 billion yuan ($105 billion). This spending supports many industries. Hotels, airlines, restaurants, and shops all benefit.

The government uses these holidays to measure economic health. Strong Golden Week numbers suggest consumer confidence. Weak numbers might indicate economic problems. This makes the statistics very important.

However, the numbers don't tell the whole story. While total spending increases, per-capita spending often decreases. This indicates that people are spending less per trip. The price war contributes significantly to this trend.

The Hidden Price War Explained

How the Price War Started

The travel price war began several years ago. It intensified after the COVID-19 pandemic. Travel companies needed to attract customers back. Lowering prices seemed like the easiest solution. This started a dangerous cycle.

Online travel agencies (OTAs) like Ctrip and Fliggy led the price cuts. They offered deep discounts on hotels and flights. Smaller companies had to match these prices. Otherwise, they would lose customers. This created intense competition.

The situation worsened as more companies joined the market. New platforms emerged with even lower prices. Established companies felt pressure to respond. This continuous undercutting hurt profit margins across the industry.

Current State of the Price War

Today's price war affects all travel sectors. Airlines offer incredibly cheap tickets. Hotels provide deep discounts. Tour packages become more affordable. But quality often suffers as prices drop.

According to CNBC research, hotel prices during Golden Week 2023 were 15-20% lower than 2019 levels. This occurred despite higher operating costs. Airlines faced similar pressure. Domestic flight prices dropped by approximately 12% compared to pre-pandemic levels.

The competition has become particularly brutal among online platforms. Companies spend heavily on marketing and discounts. They prioritize market share over profitability. This strategy is unsustainable long-term.

Impact on Travel Businesses

Hotel and Accommodation Sector

Hotels face tremendous pressure during Golden Week. They must balance occupancy rates with profitability. Many hotels operate at near-full capacity during this period. But lower room rates mean reduced profits.

Luxury hotels suffer particularly badly. They cannot maintain their premium pricing. Business hotels also struggle. Their corporate clients travel less during holidays. They must compete with vacation-oriented properties.

The situation creates several problems for hotel owners:

- Reduced profit margins per room

- Higher staffing costs during peak periods

- Increased wear and tear on facilities

- Difficulty maintaining service quality

Transportation Companies

Airlines and railway companies face similar challenges. They experience high demand during Golden Week. But competitive pricing pressures their revenue. Fuel costs and operational expenses remain high.

Domestic airlines operate more flights during peak periods. However, lower ticket prices affect their bottom line. Some routes become unprofitable despite being full. This creates financial strain.

Rail travel faces different challenges. China's high-speed rail network is extensive. Ticket prices are generally fixed. But increased capacity during Golden Week raises costs. The system must handle unprecedented passenger volumes.

Tour Operators and Agencies

Tour companies operate on thin margins during Golden Week. They compete fiercely for customers. Many offer packages at or below cost. They hope to make money through add-ons and commissions.

This approach creates several risks:

- Quality compromises to save costs

- Overcrowded tours and attractions

- Dissatisfied customers due to rushed itineraries

- Financial instability for smaller operators

Many tour guides work excessive hours during this period. They face stressed customers and crowded conditions. This leads to burnout and high turnover.

Effects on Travelers and Tourism Experience

Positive Impacts for Budget Travelers

The price war benefits cost-conscious travelers. They can access travel opportunities that were previously unaffordable. Families can take vacations that fit their budgets. Students and young travelers can explore more destinations.

Some specific benefits include:

- Lower airfares to popular destinations

- Hotel discounts of 30-50% in some cases

- Package deals that include multiple services

- Last-minute booking opportunities at reduced rates

These lower prices make travel accessible to more people. This aligns with the government's goal of increasing domestic tourism.

Negative Impacts on Travel Quality

Lower prices often mean compromised quality. Travelers may experience several problems:

- Overcrowded attractions and long queues

- Reduced service levels from stressed staff

- Basic accommodations instead of promised facilities

- Rushed itineraries that leave little time for enjoyment

According to Travel China Guide, popular sites like the Great Wall receive up to 70,000 visitors daily during Golden Week. This creates uncomfortable and sometimes unsafe conditions.

Many travelers report feeling exhausted rather than refreshed after their trips. The combination of crowds, queues, and rushed schedules diminishes the travel experience.

Practical Tips for Golden Week Travel

Smart Booking Strategies

Timing is crucial for Golden Week travel. Follow these steps for better deals:

- Book flights 2-3 months in advance for best prices

- Reserve hotels early but check cancellation policies

- Monitor prices regularly and be ready to book when they drop

- Consider travel insurance for unexpected changes

Use price comparison websites like Ctrip and Qunar. Set up price alerts for your preferred routes. Be flexible with travel dates if possible. Traveling just before or after peak dates can save money.

Avoiding Crowds and Queues

Golden Week crowds can be overwhelming. Use these strategies to avoid the worst congestion:

- Visit popular attractions early in the morning or late afternoon

- Choose less famous destinations with similar appeal

- Use online booking for tickets to skip queues

- Research alternative entrances or viewing points

Consider visiting emerging tourist destinations. Places like China's hidden gems offer great experiences with fewer crowds. Rural areas and smaller cities often provide more authentic experiences.

Budget Management Tips

Manage your travel budget effectively with these approaches:

- Set a daily spending limit and track expenses

- Use mobile payment apps for better expense tracking

- Carry some cash for places that don't accept digital payments

- Book combination tickets for multiple attractions

- Eat at local restaurants away from tourist areas

Remember that the cheapest option isn't always the best value. Consider the total experience when making choices. Sometimes paying slightly more provides significantly better quality.

Industry Responses and Future Outlook

Business Adaptation Strategies

Travel businesses are developing new approaches to survive the price war. Many focus on value-added services rather than competing solely on price. They create unique experiences that justify higher rates.

Some successful strategies include:

- Creating themed packages around specific interests

- Offering exclusive access to popular sites

- Providing personalized services and private guides

- Developing eco-tourism and sustainable travel options

Hotels are upgrading their facilities and services. They focus on creating memorable experiences rather than just providing rooms. This helps them maintain pricing power despite competition.

Government Policies and Regulations

The Chinese government recognizes the price war problem. They have implemented several measures to address it:

- Price monitoring systems to prevent predatory pricing

- Quality standards for tour operators and hotels

- Infrastructure improvements to handle peak loads

- Promotion of alternative destinations to spread crowds

According to China Daily, authorities are encouraging staggered holidays. This would reduce pressure on transportation and attractions. Some companies already implement flexible vacation policies.

Long-term Industry Trends

The travel industry is evolving in response to these challenges. Several trends are emerging:

- Increased focus on sustainable and responsible tourism

- Growth of digital platforms and mobile services

- Rising interest in experiential travel over sightseeing

- Development of smart tourism technologies

These changes may eventually reduce the intensity of price competition. Businesses that adapt successfully will thrive. Those stuck in old models may struggle to survive.

Frequently Asked Questions

What is the best time to book Golden Week travel?

Book 2-3 months in advance for best selection and prices. Last-minute deals exist but choices are limited. Monitor prices regularly as airlines and hotels adjust rates based on demand.

How crowded are popular attractions during Golden Week?

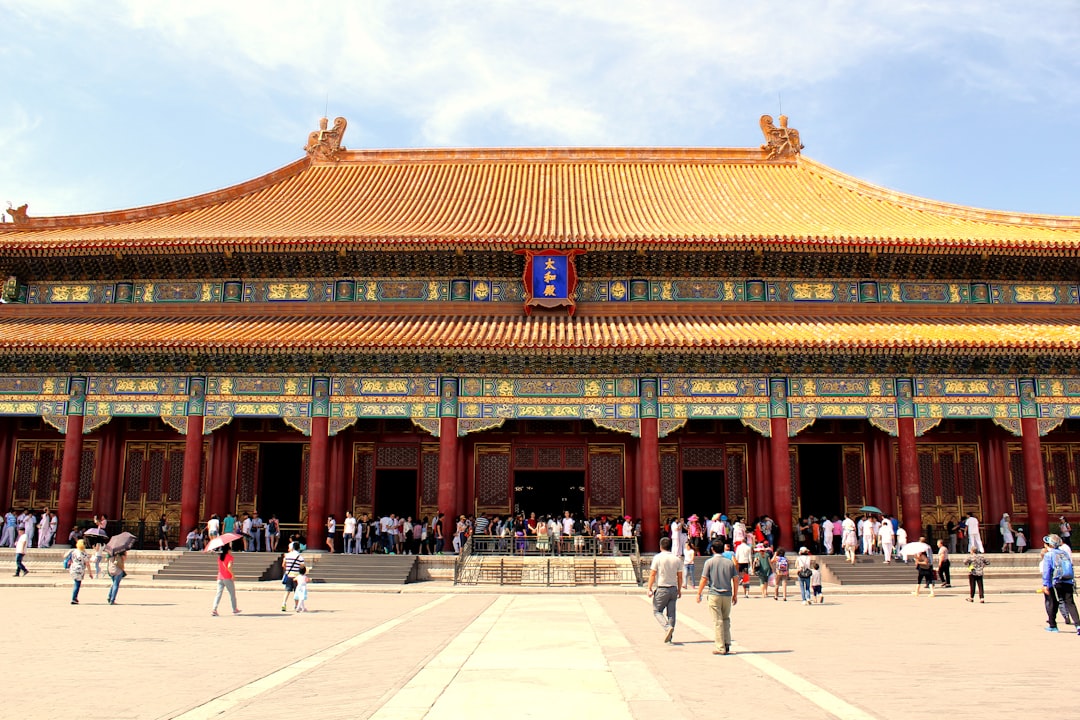

Extremely crowded. Major sites like the Forbidden City and Great Wall see visitor numbers 3-5 times normal levels. Wait times can exceed 2-3 hours for popular attractions. Consider less famous alternatives for better experiences.

Are price wars good for travelers?

They provide short-term benefits through lower prices. However, they often lead to reduced service quality and overcrowding. Sustainable pricing benefits both travelers and businesses long-term.

How can I avoid the worst crowds?

Visit popular sites early morning or late afternoon. Choose weekdays over weekends. Research alternative destinations with similar appeal. Use online booking to skip ticket queues.

What happens if I need to cancel my trip?

Cancellation policies vary by provider. Many offer full refunds if canceled sufficiently early. Last-minute cancellations may incur fees. Travel insurance can protect against unexpected changes.

Is international travel affected by Golden Week?

Yes, outbound travel increases significantly during Golden Week. Popular international destinations see more Chinese tourists. Prices for international flights and packages often rise due to high demand.

How has COVID-19 changed Golden Week travel?

The pandemic increased domestic travel as international options decreased. Health precautions like temperature checks and health codes became standard. Recovery has been gradual but steady since restrictions eased.

Real Examples and Case Studies

Zhangjiajie National Forest Park Experience

This famous park in Hunan province illustrates the crowding problem. During Golden Week 2023, daily visitors reached 50,000—double the recommended capacity. Wait times for cable cars exceeded three hours. Many visitors reported spending more time queuing than enjoying the scenery.

Local hotels were fully booked but revenue per room declined 18% compared to 2019. This occurred despite higher operating costs. The park management implemented timed entry systems to manage crowds. However, the experience remained challenging for most visitors.

Shanghai Disneyland Pricing Strategy

Shanghai Disneyland adopted dynamic pricing during Golden Week. Ticket prices increased by 30-50% during peak days. This helped manage crowd levels and maintain service quality. Despite higher prices, the park operated at near capacity throughout the holiday.

This approach demonstrates that some travelers will pay premium prices for better experiences. Other theme parks are adopting similar strategies. They focus on value creation rather than competing solely on price.

Chengdu Hotpot Restaurant Innovation

A popular hotpot chain in Chengdu created special Golden Week packages. They combined meals with cultural performances and cooking classes. Prices were 20% higher than regular dining. However, the packages sold out weeks in advance.

This example shows how businesses can escape price wars through innovation. By creating unique experiences, they attract customers willing to pay premium prices. This approach benefits both businesses and customers.

Statistics and Data Analysis

Travel Volume Trends

Golden Week travel has grown consistently over the past decade. According to Statista, National Day Golden Week trips increased from 428 million in 2013 to 826 million in 2023. This represents average annual growth of approximately 7%.

However, growth rates have slowed in recent years. The pandemic caused a temporary decline in 2020-2021. Recovery has been strong but patterns have changed. Domestic travel has replaced some international trips.

Spending Patterns

Total tourism spending continues to increase. But per-capita spending tells a different story. According to China's Ministry of Culture and Tourism, per-capita spending during Golden Week 2023 was 912 yuan ($127). This represents a 5% decrease from 2019 levels after adjusting for inflation.

This decline reflects the intense price competition. Travelers are paying less for similar services. Businesses accept lower margins to maintain market share. This trend is unsustainable long-term.

Destination Popularity

Traditional destinations remain popular but alternatives are growing. Beijing, Shanghai, and Xi'an still top destination lists. However, second-tier cities like Chengdu, Chongqing, and Hangzhou are gaining popularity.

According to CEIC Data, visits to emerging destinations increased 23% in 2023 compared to 2022. This dispersion helps reduce pressure on overcrowded sites. It also spreads economic benefits more widely.

Step-by-Step Guide to Smart Golden Week Planning

Step 1: Early Research and Destination Selection

Begin planning 3-4 months before Golden Week. Research potential destinations considering crowd levels, weather, and personal interests. Create a shortlist of 2-3 options. Check historical visitor data for each destination.

Consider factors beyond popularity. Look for places with good infrastructure and multiple attraction options. Balance famous sites with less crowded alternatives. This approach ensures a better overall experience.

Step 2: Budget Planning and Allocation

Set a realistic budget based on your research. Allocate funds across different categories:

- Transportation (40-50% of total budget)

- Accommodation (25-30%)

- Food and activities (20-25%)

- Contingency fund (5-10%)

Research average costs for your chosen destinations. Add 10-15% buffer for unexpected expenses. Use budgeting apps to track your planning and actual spending.

Step 3: Booking Strategy Implementation

Book transportation first as options diminish quickly. Reserve accommodations next, prioritizing flexible cancellation policies. Finally, book activities and tours, focusing on skip-the-line options where available.

Use this booking sequence:

- Flights or train tickets (2-3 months ahead)

- Hotels or rental properties (1-2 months ahead)

- Major attraction tickets (1 month ahead)

- Restaurant reservations and tours (2-3 weeks ahead)

Step 4: Preparation and Contingency Planning

Prepare necessary documents and confirm all bookings. Download relevant apps for navigation, translation, and payments. Create a digital backup of important information.

Develop contingency plans for common problems:

- Alternative activities if attractions are too crowded

- Backup transportation options in case of delays

- List of nearby medical facilities and emergency contacts

- Digital and physical copies of important documents

Conclusion: Navigating the New Travel Reality

China's Golden Week presents both opportunities and challenges. The travel boom creates economic benefits but masks underlying problems. The price war hurts businesses and often diminishes traveler experiences. Understanding this dynamic helps everyone make better decisions.

Travelers can benefit from lower prices but must manage expectations. Crowds and reduced service quality are real concerns. Smart planning and alternative destinations can mitigate these issues. The goal should be value rather than just low cost.

Businesses face difficult choices in this competitive environment. Those that innovate and focus on quality will likely succeed. Price-based competition alone is unsustainable. Creating unique experiences provides a path to better profitability.

The government's role remains crucial. Policies that encourage sustainable tourism and manage crowd flows help everyone. Infrastructure improvements and promotion of alternative destinations spread benefits more widely.

Golden Week will continue evolving. The price war may eventually ease as businesses find better models. Travelers are becoming more sophisticated in their choices. The future likely holds more balanced approaches that benefit all stakeholders.

For your next Golden Week trip, remember these key points. Plan early, research thoroughly, and prioritize experience over price. Consider sustainable travel options when possible. Your choices as a traveler influence how the industry develops. Smart travel decisions create better outcomes for everyone involved.